Welcome to our Amazon Credit Card Login Guide & Tips. It’s here to help you easily manage your Amazon card account. Knowing how to securely log in is key for handling your finances and enjoying your card’s benefits. In this guide, you’ll learn how to sign in, fix common problems, and get the most from your card.

We’ll give you the confidence to handle your account smoothly. You’ll get the tools to manage it without a hitch.

Key Takeaways

- Learn the types of credit cards available for both Amazon personal and business use.

- Discover the benefits and rewards associated with each credit card.

- Follow step-by-step instructions for securing your Amazon credit card account.

- Understand how to make secure online payments and avoid common pitfalls.

- Gain insights into account settings and effective management strategies.

Understanding Your Amazon Credit Card Options

Exploring Amazon’s credit card options can make shopping better and offer many benefits. Amazon has cards for different needs, like the Amazon Store Card and Amazon Visa Card. Each card has special perks, helping you choose based on how you spend.

Types of Amazon Credit Cards

The main credit cards from Amazon are:

- Amazon Prime Visa Card: Great for Prime members, it gives 5% back at Amazon and Whole Foods. It also offers cashback on other categories.

- Amazon Visa Card: For those not in Prime, it offers 3% back at Amazon and Whole Foods. It’s good for those who shop a lot.

- Amazon Store Card: Only for Amazon use, it gives 5% back to Prime members. It also offers 0% financing on purchases over $150.

- Amazon Prime Store Card: It combines the store card benefits with Prime member perks.

- Amazon Secured Card: Perfect for those with little credit history. It helps build credit.

Benefits of Using Amazon Credit Cards

Using an Amazon credit card has many advantages, including:

- Cashback Rewards: The Prime Visa and Amazon Visa offer cashback on purchases. Prime members get 5% back at Amazon and Whole Foods. Non-members get 3% back.

- Sign-up Bonuses: New cardholders can get Amazon gift cards when they open an account.

- Purchase Protection: Cardholders get benefits like zero fraud liability and travel protections.

- Financing Options: The Amazon Store Card offers special financing on big purchases. This helps manage large expenses.

Who Can Apply for an Amazon Credit Card

Knowing who can apply for an credit card is important. Generally, you need to:

- Be at least 18 years old

- Have a valid Social Security number

- Have good credit, with scores of 710 or higher

- Meet income requirements based on your lifestyle and spending

With many Amazon credit card options, you can find one that fits your shopping style. You’ll get rewards and financing choices.

How to Access Your Amazon Credit Card Account

Logging into your Amazon credit card account is key for managing your money well. It’s easy but needs some focus. Here’s how to sign in smoothly.

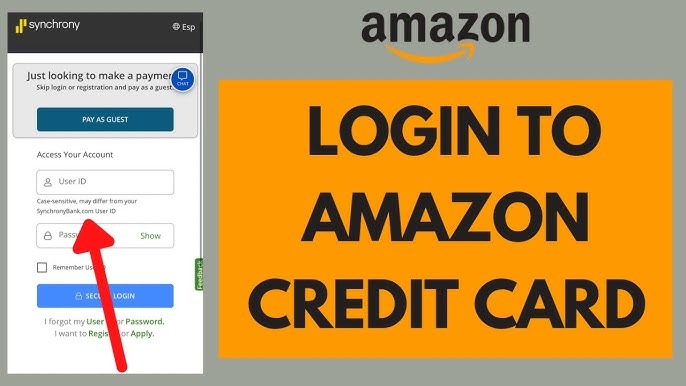

Step-by-Step Login Procedures

To log into your Amazon credit card account, follow these steps:

- Go to the Amazon homepage and find the “Sign In” at the top right.

- Click on it to go to the login page.

- Type in your Amazon email or mobile number in the field.

- Enter your password carefully to avoid mistakes.

- For amazon synchrony card login, hit the “Sign In” button.

- If two-factor authentication is on, follow the steps to verify.

- After signing in, go to your account settings to manage your card.

- Log out when done to keep your account safe.

Troubleshooting Common Login Issues

Dealing with login problems is common. Here are some fixes for common issues:

- Forgot Password: Click “Forgot Password?” on the login page and reset it.

- Browser Issues: Try a different browser or clear your cache and cookies.

- Account Locked: If you try wrong passwords too many times, your account might lock. Wait or call customer support.

- No Access to Email: If you can’t get to your email, use Amazon’s account recovery options.

Knowing how to log into your Amazon credit card account helps manage your money better. These simple steps make signing in easy and solve common problems.

Credit Card Login Amazon

Logging into your Amazon Chase card is key for managing your money well. Keeping your Amazon credit card safe is very important because of online risks. By using good security, you can protect your personal info better.

Secure Your Amazon Credit Card Account

To keep your Amazon credit cards safe, follow these easy steps:

- Update your password regularly: Pick a strong, unique password that’s hard for others to guess.

- Enable two-factor authentication: This adds extra security, helping keep your account safe from unauthorized access.

- Monitor account activity: Check for any odd transactions and report them right away.

- Be aware of phishing attempts: Always check if emails or messages asking for your login info are real.

Managing Your Account Settings Effectively

Improving your credit card settings can make your experience better. Here are some tips for better account management:

- Set up transaction notifications: Get alerts for any transactions, keeping you updated and safe.

- Review and customize your communication preferences: Change your settings for updates on deals and new features.

- Establish payment reminders: Set reminders for payments to avoid late fees and interest.

- Check your credit card rewards: Keep an eye on your rewards program to get the most from your purchases.

By following these tips, you can manage your credit card settings well. These steps will help keep your info safe and make online shopping better.

Making Payments on Your Amazon Credit Card

Managing your Amazon credit card payment is key to keeping your finances healthy. You can pay online easily to keep your account up to date. Knowing when payments are due and any fees helps you avoid extra costs and get the most from your card.

How to Make Payments Online

Making online payments is easy and quick. Here’s how to do it:

- Log into your Amazon account.

- Navigate to the account settings and select your credit card details.

- Choose the “Make a Payment” option.

- Enter the amount you wish to pay.

- Select your payment method (bank transfer or debit card).

- Confirm the payment.

The Amazon Store Card app makes managing your payments even easier. You can check your transactions and rewards points on your phone. It also lets you view your digital card and set reminders for payment due dates.

Understanding Payment Due Dates and Fees

Knowing your payment due dates is important to avoid late fees. These fees can add up quickly. Here’s a quick guide:

| Due Date Type | Description | Potential Fee |

|---|---|---|

| Regular Payment Due Date | Date on which your payment is considered late if unpaid. | $30 or more |

| Minimum Payment Due | The least amount you can pay to keep your account from going into default. | Varies based on outstanding balance |

| Late Fee for Overdue Payments | Charged when payment is not made by the due date. | Up to $40 |

By sticking to your payment schedule and knowing about late fees, you can protect your finances. Regular payments help you get the most from your Amazon credit card without extra costs.

Conclusion

Managing your Amazon credit card well is key to getting the most out of it and keeping your finances healthy. By following the right tips, you can make the most of your rewards and improve your credit score. It’s also important to know how to log in securely and protect your personal info.

Keeping up with payment due dates and using your card’s features wisely is also important. Whether you decide to cancel your Amazon Store Card or keep it, making an informed choice affects your credit history. Don’t forget to use any rewards you have before canceling, and know that even a card with no balance can help your credit score.

Understanding the impact of your actions with your credit card is vital. By following these tips, you can handle your finances better and keep your credit in good shape. Make sure to log in securely and pay on time to enjoy a safe and rewarding experience with your credit card.

FAQ

How do I access my Amazon credit card account?

To get into your credit card account, go to the Amazon Payments page. Click on “Credit Cards” and then log in with your details. Use your Amazon credit card login or store card login to continue.

What are the benefits of an Amazon Visa Card?

The Amazon Visa Card lets you earn rewards on eligible purchases. It also offers special financing options and zero fraud liability protection. This helps you get the most out of your shopping on Amazon.

What should I do if I forget my credit card password?

If you forget your password, visit the Amazon credit card login page. Click on “Forgot Password” to reset it securely. This is key to getting back into your account.

How can I make payments on my Amazon credit cards?

To pay your Amazon credit card online, log in to your account. Go to the payment section and follow the instructions. Always check your payment due dates to avoid late fees.

What are the eligibility requirements for applying for an Amazon credit card?

To apply for an Amazon credit card, you must be at least 18 years old. You also need a valid Social Security number. Plus, you must meet certain credit criteria set by the bank, like Synchrony or Chase.

How do I manage my account settings on my credit card?

To manage your account settings, log in to your Amazon credit card account. Go to the settings section. There, you can update your info, set up transaction alerts, and adjust payment reminders.

Is there a way to secure my credit card account?

Yes, to secure your Amazon credit card account, update your password regularly. Enable two-factor authentication and watch out for phishing scams. Always keep your personal info private.

Can I use my Amazon Store Card for purchases outside of Amazon?

The Amazon Store Card is mainly for Amazon.com purchases. It’s not usually good for outside purchases. But, Amazon’s Visa option can be used anywhere Visa is accepted.

How can I troubleshoot login issues with my Amazon Synchrony Card?

If you’re having trouble logging in with your Amazon Synchrony Card, check your login details. If issues continue, clear your browser cache or try a different browser. If needed, reach out to customer support.